Childcare fees can strain monthly cash flow, and subsidies lower those costs when eligibility and provider rules align.

This article helps you confirm your eligibility, choose approved services, and apply correctly across major programs so your invoices reflect the support you qualify for without avoidable delays.

Definition And Purpose

Subsidized childcare refers to financial assistance that lowers out-of-pocket fees for licensed care so parents can work, study, or job hunt.

Programs aim to expand access to quality care, support employment, and strengthen children’s learning and social development.

How Payments Flow

Most programs pay approved providers directly after an eligibility assessment and enrollment confirmation, which means invoices already reflect the subsidy amount.

Some regions reimburse families after receipt submission, although provider payment is more common and reduces monthly cash strain.

Co-Payment And Fee Gaps

Most awards require a co-payment that remains your responsibility under the agreement.

Agencies frequently cap funded rates using market studies; when a center’s tuition exceeds those caps, the difference becomes an additional out-of-pocket charge.

Who Qualifies: Core Eligibility

Complex rules cause avoidable denials, so align your situation to the typical criteria first.

- Meet household requirements such as citizenship or permanent residency where applicable, plus residence in the service area defined by the program.

- Use a licensed or otherwise approved provider, remain responsible for fee payment, and maintain attendance records that match the program’s reporting rules.

- Satisfy child criteria including age limits, immunisation standards, and education status, noting that many programs exclude children in secondary school unless disability supervision applies.

- Demonstrate recognised activity hours, which can include employment, active job search, formal study, approved training, charity work, or setting up a business.

- Disclose the number of children in care and total household income, since multi-child rules and income bands often increase the subsidy percentage for younger siblings.

How To Apply: Step-By-Step

Small mistakes slow decisions, so prepare documentation and align provider status before submitting anything.

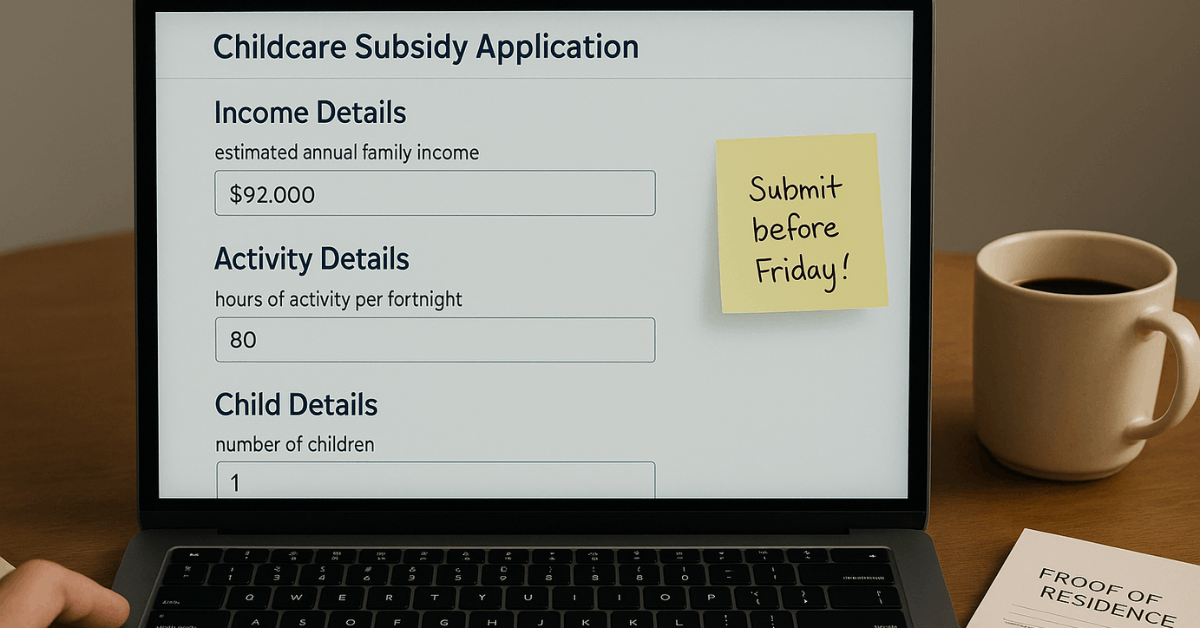

- Confirm eligibility against income bands, residency rules, child age and immunisation requirements, recognised activity hours, and the number of children requiring care.

- Select an approved or licensed provider and verify participation in the relevant subsidy program to ensure direct payment and invoice reductions.

- Gather documents such as identification, proof of residence, income statements, activity evidence, immunisation records, and custody schedules showing percentage of care.

- Submit the application through the official portal or agency, respond to requests for further evidence, and monitor status until the assessment letter shows your percentage and hourly cap.

- Review the first subsidised invoice for accuracy, track attendance carefully, and update the agency immediately when income, activity hours, or the number of children in care changes.

How Subsidies Operate Inside Centers

Directors and administrators follow stringent procedures that affect billing timelines and family charges.

Center Participation And Compliance

Centers usually opt in, complete training, and accept audits from a municipal council or third-party agency acting for the state or province.

Regulations come from higher levels of government, while local agencies manage distribution, as seen in programs such as CalWORKs in California.

Attendance, Billing, And Dispute Windows

Daily in-out times must be captured for every enrolled subsidised child and submitted on schedule.

Payments arrive via direct deposit, cheque, or program debit card in lump sums, accompanied by per-child remittance reports that require quick review, since dispute windows are short and underpayments must be contested promptly.

Software And Record-Keeping

Subsidy management tools help centers track eligibility, balances, and renewals alongside private-pay accounts. Efficient systems reduce administrative errors that otherwise trigger funding holds or parent back-billing.

Australia: Child Care Subsidy (CCS)

Australian families benefit from updated rate caps and thresholds that broaden access and increase the maximum percentage.

Key Caps And Threshold (Effective 8 July 2024)

| Item | Under School Age | School Age |

|---|---|---|

| Centre-Based Day Care Hourly Rate Cap | $14.29 | $12.51 |

| Outside School Hours Care Hourly Rate Cap | $14.29 | $12.51 |

Additional Update: The family income threshold for the 90% rate increased from $80,000 to $83,280, allowing more households to qualify for the maximum subsidy.

Eligibility Snapshot And Claiming

Primary caretakers generally must be citizens or permanent residents, provide at least 14% care (two nights per fortnight), and remain responsible for fees at an approved service.

Children must meet immunisation requirements and typically not attend secondary school, with disability supervision exemptions available. Claims proceed through approved providers, which receive payments directly and reduce invoices accordingly.

Additional Child Care Subsidy

Added support may apply during temporary financial hardship, for grandparents, or while transitioning to work, provided the relevant conditions are met.

Canada And United States: Program Availability

Regional models differ, yet the goal remains consistent across provinces and states.

Canada

Many providers participate in the federal affordable childcare initiative that targets fees as low as ten dollars per day, subject to provincial implementation and provider opt-in.

Alberta families with combined gross income under $180,000 may receive additional subsidies to further reduce center fees, which stack with base affordability measures where available.

United States

The Child Care and Development Fund supplies federal grants that states convert into their own programs, each with specific eligibility, provider approval standards, and payment levels.

Parents typically select a licensed provider and receive assistance through vouchers or direct provider payment, with local examples including CalWORKs in California and state-level options in New York.

Frequently Asked Questions

Short, targeted answers help resolve the most common issues that delay approvals and increase bills.

How Does CCS Interact With Free Kindy In Queensland?

Children who are at least four years old by 30 June in the year before Prep can receive up to fifteen free kindergarten hours weekly for forty weeks.

CCS can still apply to wrap-around hours beyond the free allocation and to any additional booked days at approved providers.

How Is The Subsidy Percentage Determined?

Awards typically reflect household income, the type of service used, recognised activity hours for each caretaker, and the number of children enrolled, with many programs funding up to ninety percent for lower incomes within set caps.

Can Assistance Apply To Every Child In Care?

Eligibility calculations account for all children, and declarations can be updated on an existing claim without submitting separate applications for each child. Several programs raise the percentage for the second child when more than one child aged five or younger attends care.

Is Employment Mandatory To Qualify?

Employment is not always required, since recognised activities often include formal study, approved training, active job search, charity work, maternity leave, paternity leave, and documented business setup activities, provided evidence is supplied.

Tools And Administration For Centers

Efficient operations at the provider level protect family budgets and keep funding uninterrupted.

Daily Operations And Audits

Accurate attendance capture, secure document storage, and timely report submission keep payments flowing and reduce the risk of retroactive adjustments.

Local agencies audit periodically, so maintaining reconciled ledgers and family communication logs remains essential.

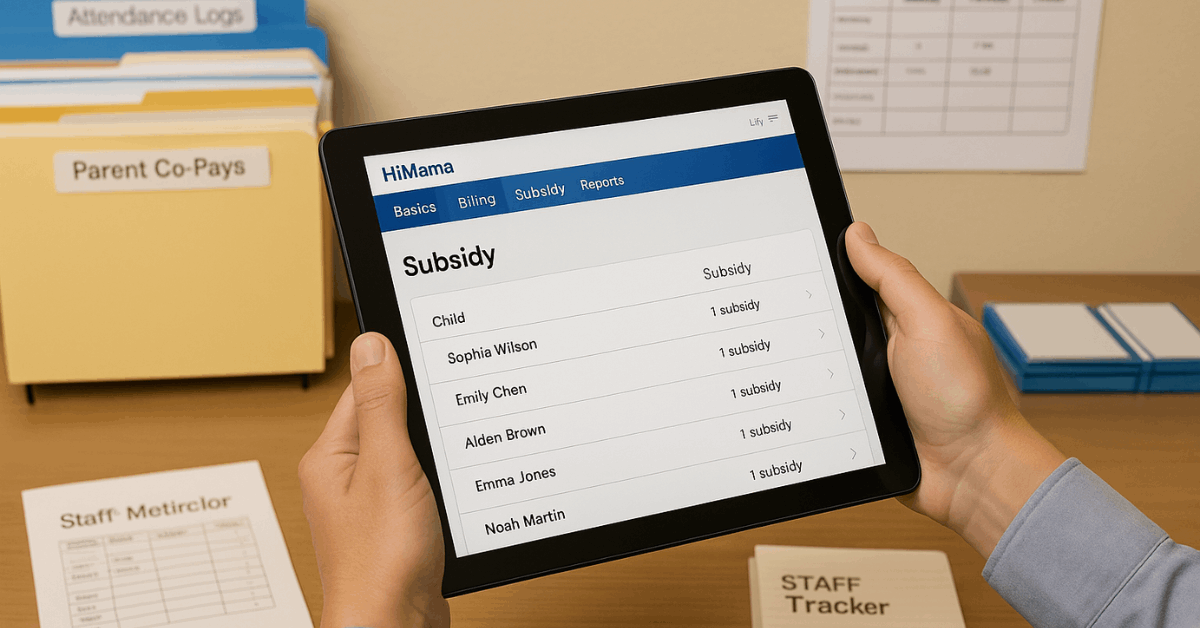

HiMama Billing Example

Centers using HiMama’s billing module can create, manage, and track subsidies in one place.

The subsidies tab lists all recorded subsidies, sorts the newest entries first, and supports quick lookups by child name or date range filter, which simplifies reconciliation against agency remittance files.

Quick Regional Pointers

Finding the correct portal speeds approvals and reduces back-and-forth.

- Ontario, Canada: Check provincial childcare subsidy pages for municipal application links and required documents.

- California, US: Review county-specific CalWORKs childcare guidance and approved provider lists.

- New York, US: Consult county social services sites for CCDF-funded voucher details and provider eligibility rules.

- Alberta, Canada: Verify income thresholds, rate reductions, and licensed program participation for combined affordability and subsidy benefits.

Do you want me to convert this into a clean, SEO-friendly DOCX or PDF where the heading sizes are visually distinct for publication? It’ll look much more polished. Should I?

Conclusion

Securing subsidized childcare depends on matching your household profile to program rules, using approved providers, and submitting complete evidence on time.

Keep your records current, check each remittance and invoice against your award, and report any changes immediately. Apply early, track attendance accurately, and use dispute windows to correct underpayments.