JACCS Loan is a financing option that helps you cover personal expenses with flexible repayment terms.

To be eligible for a successful application, you must understand the eligibility requirements, the required documents, and the applicable fees.

This guide clearly explains the process, allowing you to prepare and apply with confidence.

Overview of JACCS Loan

JACCS Loan offers a range of financing solutions tailored to your specific needs. Understanding its main features helps you decide if it fits your situation.

Here are the key points you should know:

- Covers personal loans for various purposes.

- Flexible repayment terms that can be adjusted.

- Loan amounts vary based on income and credit standing.

- Interest rates are competitive compared to similar lenders.

- Application is available both online and offline.

Loan Types

JACCS offers a variety of loan types to suit your financial needs. Each option has its own purpose and conditions. Here are the main types:

- Personal Loan – for daily expenses, education, or medical costs.

- Car Loan – for purchasing new or used vehicles.

- Credit Loan – a flexible loan linked to your credit line.

- Shopping Loan – installment plan for purchases at partner stores.

- Card Loan – quick access to funds through your JACCS card.

Eligibility Criteria

To qualify for the loan, you must meet specific requirements. These criteria ensure that you have the capacity to borrow and repay responsibly.

Here are the main eligibility conditions:

- Age Requirement – applicants must usually be between 20 and 65 years old.

- Residency – must be a legal resident of Japan with valid identification.

- Income – must have a stable source of income, either from employment or self-employment.

- Employment Status – full-time, part-time, or self-employed applicants may apply if their income is consistent.

- Credit History – a positive credit record increases the chances of approval.

Required Documents

When applying, you need to provide documents that confirm your identity, income, and residence.

Preparing them in advance helps speed up the process. The main requirements are:

- Valid Identification – passport, residence card, or driver’s license.

- Proof of Income – salary slips, tax certificates, or recent bank statements.

- Employment Verification – certificate of employment or contract (if needed).

- Bank Account Information – for disbursement and repayments.

- Proof of Address – utility bill or residence certificate.

Step-by-Step Application Process

Here’s how you can apply for a JACCS Loan. The process is straightforward, but you must prepare the necessary details and documents. Follow these steps:

- Step 1: Online or In-Person Application – choose to apply through the JACCS website, mobile app, or at a partner office.

- Step 2: Fill Out Personal Information – provide your name, address, income, and employment details.

- Step 3: Submit Required Documents – upload or hand in ID, proof of income, and bank details.

- Step 4: Application Review – JACCS reviews your credit history and verifies information.

- Step 5: Approval Notification – receive confirmation by email, phone, or mail.

- Step 6: Loan Disbursement – funds are transferred to your registered bank account.

Interest Rates and Fees

Interest rates and fees are essential to check before applying.

They determine the total cost of borrowing and can affect your repayment plan. Here are the key details:

- Interest Rate – usually ranges from 4.5% to 18.0% annually, depending on loan type, amount, and credit evaluation.

- Processing Fee – some loan types may include a small origination or administrative fee.

- Late Payment Penalty – around 20% annually applied to overdue amounts.

- Early Repayment – generally allowed without extra charges, but confirm with JACCS.

- Other Charges – service fees may apply for special requests, such as changes to the repayment schedule.

Repayment Options

Repayment flexibility is a crucial aspect of borrowing. JACCS offers several options to ensure timely payments. Here are the main options available:

- Monthly Installments – fixed payments scheduled each month.

- Direct Bank Debit – automatic deductions from your registered bank account.

- ATM or Convenience Store Payment – selected repayment methods through affiliated networks.

- Online Payment – pay through the JACCS website or mobile app.

- Early Repayment – settle the balance ahead of schedule, often without penalties.

Common Reasons for Application Rejection

Not all applications get approved. Rejections often happen when requirements are not fully met or financial risks are high. Here are the common reasons:

- Low or Unstable Income – not enough proof of steady earnings.

- Poor Credit History – past defaults or unpaid debts.

- Incomplete Documents – missing ID, income proof, or incorrect details.

- High Debt-to-Income Ratio – too many existing loans compared to income.

- Age or Residency Issues – not within the required age range or lacking legal residency.

Tips to Improve Approval Chances

You can improve your chances of approval by preparing carefully. Lenders look for stability and accuracy in applications. Here are practical tips:

- Maintain a Good Credit Record – pay bills and debts on time.

- Show Stable Income – provide clear proof of regular earnings.

- Prepare Complete Documents – double-check all forms and attachments before submission.

- Limit Existing Debt – reduce outstanding loans or credit card balances.

- Apply Within Criteria – make sure your age, residency, and employment meet the requirements.

Managing Your Loan Responsibly

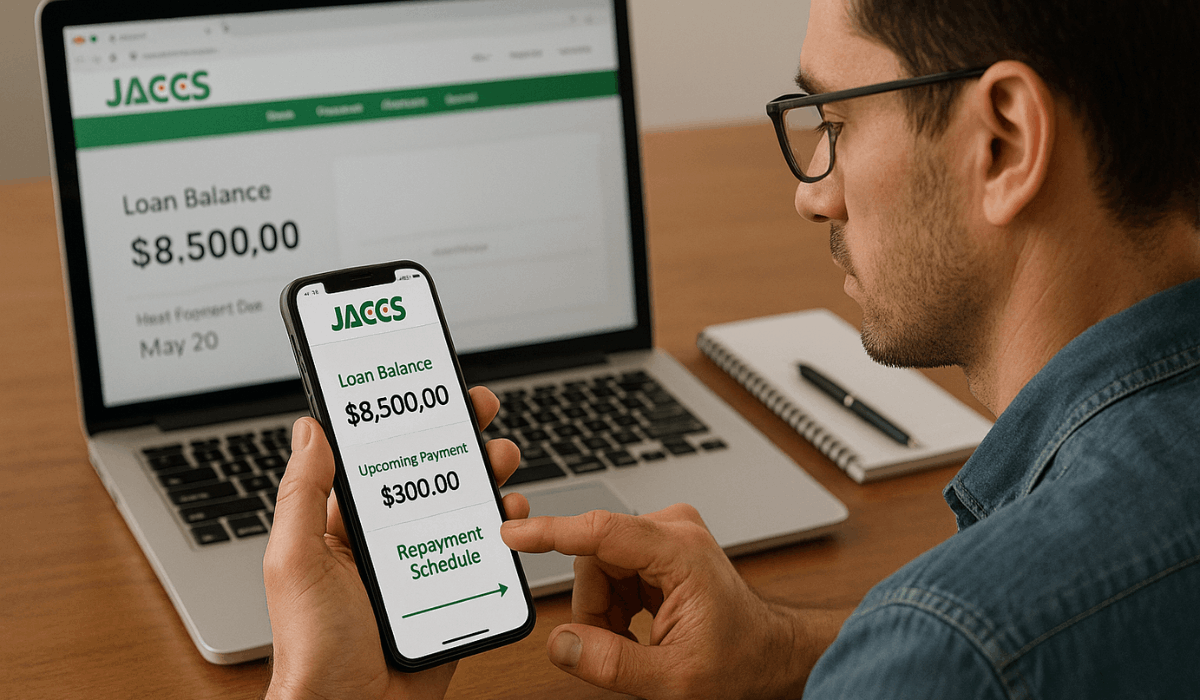

Once your loan is approved, managing it well is key to avoiding financial stress.

Responsible use helps maintain a healthy credit record and facilitates more manageable repayment. Here are the main points to follow:

- Pay on Time – always meet your monthly due dates to avoid penalties.

- Track Your Balance – check your account regularly through the app or online portal.

- Budget Properly – set aside funds each month to cover repayment.

- Avoid Unnecessary Borrowing – don’t take additional loans if not needed.

- Use Early Repayment Option – clear your balance sooner when possible to reduce interest.

- Communicate with Lender – contact support immediately if you face repayment difficulties.

Customer Support and Contact Information

If you need assistance with your account or services, JACCS offers different contact lines depending on the issue:

- General Inquiries – For matters such as early lump-sum or partial repayment, balance checks, or updating personal information, call 050-3618-1677.

- Lost or Stolen Card – Use the automated telephone service. If you don’t know your card number, follow the prompts to connect with a customer service representative.

- Missed Payment Inquiries – Contact the JACCS Contact Center directly for guidance on repayment.

- Headquarters (General Business) – For corporate inquiries, call the main switchboard at 03-5448-1311. Note: this is not a customer service line.

To Sum Up

Applying for a JACCS Loan is straightforward once you understand the requirements, documents, and fees.

Meeting the eligibility criteria and preparing your application carefully will increase your chances of approval.

Take the next step today by reviewing the details and applying through the official JACCS website or app.

Disclaimer

All details about eligibility, fees, and interest rates are subject to change without prior notice.

Always verify the latest information directly with JACCS before applying.