Public pensions offer a dependable source of income in retirement.

Understanding contribution requirements and the process to claim benefits is essential for planning your future.

This guide provides clear information to help you maximize your pension and avoid common mistakes.

Overview of Public Pension Systems

A public pension system is a government program that provides a regular income to individuals after retirement.

It helps ensure financial security for people who have contributed during their working years.

Types of Public Pensions

Public pensions come in various forms, depending on the type of employment and the specific government programs involved.

Knowing the types helps you understand which benefits you are eligible to receive.

- State Pension: Standard pension provided by the government to eligible citizens based on age and contributions.

- Social Security Pension: Common in some countries, funded by payroll taxes for retirement, disability, and survivor benefits.

- Occupational Pension: Provided by employers as part of employment benefits, sometimes mandatory.

- Contributory Pension: Requires you to pay a portion of your income into the fund to receive benefits later.

- Non-Contributory Pension: Funded entirely by the government, often for low-income or disadvantaged citizens.

- Disability Pension: Supports individuals who are unable to work due to a disability.

- Survivor or Widow Pension: Paid to family members after a contributor passes away.

Contribution Requirements

Contributing to a public pension is crucial for securing your future benefits.

Understanding the requirements ensures that you meet the eligibility criteria and receive the correct pension amount.

- Minimum Age for Contributions: Most systems require you to start contributing once you enter the workforce.

- Minimum Contribution Period: You must contribute for a set number of years to qualify for full benefits.

- Employee Contributions: A percentage of your salary is automatically deducted and sent to the pension fund.

- Employer Contributions: Employers often contribute a matching or set portion on your behalf.

- Self-Employed Contributions: Self-employed individuals are responsible for paying the full contribution themselves.

- Documentation Required: Typically, proof of employment, income statements, and identification are required.

- Voluntary Contributions: Some systems allow additional payments to increase your future benefits.

Eligibility Criteria

Eligibility criteria determine who is eligible to receive a public pension and under what circumstances. Meeting these requirements is essential to ensure you qualify for full benefits.

- Age Requirement: Most pensions require individuals to reach a specific retirement age to claim benefits.

- Minimum Contribution Period: You must contribute for a certain number of years to be eligible.

- Employment Status: Some pensions require formal employment or proof of self-employment.

- Residency or Citizenship: Eligibility may depend on whether you are a resident of the country or hold citizenship.

- Documentation: ID, employment records, and contribution history are needed to verify eligibility.

- Special Circumstances: Disability, survivor status, or military service can modify eligibility requirements.

How to Claim Benefits

Claiming your public pension is the final step to accessing your retirement funds. Knowing the process ensures you receive your benefits without delays or errors.

- Application Process: Complete the required forms with personal and employment details.

- Submission Channels: Applications can often be submitted online, by mail, or in person at pension offices.

- Required Documentation: Provide identification, proof of contributions, and other supporting records.

- Processing Time: Benefits are typically reviewed and approved within a specified timeframe, which varies by system.

- Receiving Payments: Pensions are typically paid monthly via direct deposit or check.

- Tax Considerations: Be aware of any taxes that may be applied to pension income.

- Follow-up: Track your application status and contact the pension authorities as needed for updates.

Special Considerations

Certain situations can affect your pension contributions or the benefits you receive.

Understanding these special considerations helps you plan more effectively and avoid surprises.

- Early Retirement: Retiring before the standard retirement age may result in a reduced pension amount.

- Career Breaks: Periods of unemployment or unpaid leave can impact eligibility or benefit calculations.

- Disability: Pensions may be adjusted if you become unable to work due to health issues.

- Survivor Benefits: Family members may receive benefits after a contributor’s death.

- Part-Time Work: Contributing less due to part-time work can result in a reduced pension.

- Voluntary Contributions: Extra contributions can increase your future pension.

- Legislative Changes: Government rules can change, affecting eligibility or benefit amounts.

International Workers and Pension Portability

If you work in multiple countries, your public pension benefits may be affected.

Understanding pension portability helps you combine or transfer contributions to maximize your retirement income.

- Bilateral Agreements: Some countries have treaties allowing workers to combine contribution periods.

- Multilateral Agreements: Regional agreements, such as those within the EU, facilitate the coordination of pension benefits across member states.

- Eligibility Across Borders: You may qualify for benefits in more than one country if you meet each country’s criteria.

- Transfer of Contributions: Certain systems enable the transfer of pension contributions from one country to another.

- Calculating Benefits: Pensions are often prorated based on the time contributed in each country.

- Documentation Needed: Proof of employment and contributions in each country is required.

- Tax Implications: Receiving pensions from multiple countries may have tax consequences.

Pension Reviews and Appeals

Sometimes pension claims may have errors or delays. Knowing how to review and appeal decisions ensures you receive the benefits you are entitled to.

- Filing a Review: Request a review if you believe your pension calculation is incorrect.

- Required Documentation: Include ID, contribution records, and any supporting evidence.

- Submission Channels: Reviews can often be submitted online, by mail, or in person.

- Deadlines: Appeals must be filed within a specific time frame set by the pension authority.

- Outcome Options: Decisions may confirm, adjust, or overturn the original benefit.

- Further Appeals: If unsatisfied, higher-level appeals or tribunals may be available.

- Follow-Up: Track the status of your review and maintain communication with pension officials.

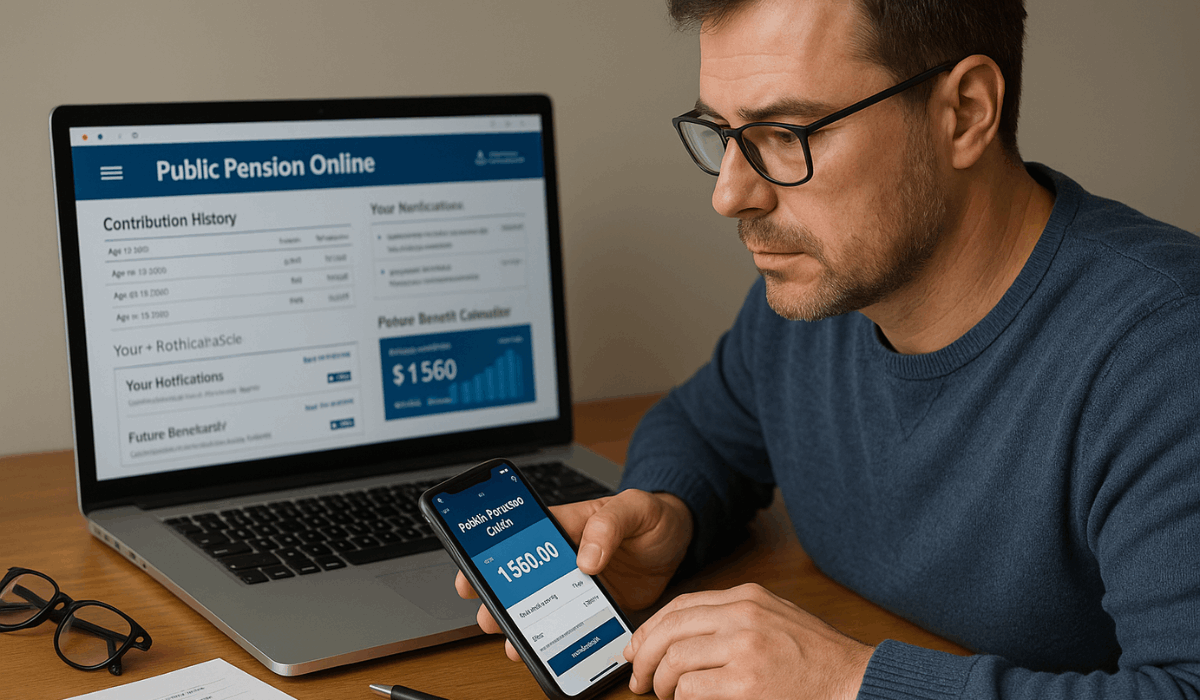

Digital Tools and Online Pension Management

Digital tools make managing your public pension easier and more efficient.

Using online portals helps you track contributions, submit documents, and stay updated on benefits.

- Online Portals: Access your pension account to review contributions and benefit statements.

- Submitting Forms: Upload applications and documents securely through digital platforms.

- Updating Personal Information: Change address, banking details, or contact info online.

- Notifications and Alerts: Receive updates on contribution changes, deadlines, or legislative updates.

- Calculators and Estimators: Estimate future pension amounts based on current contributions.

- Support Services: Chatbots, help centers, and customer support can assist with inquiries.

- Mobile Apps: Some systems offer mobile apps for easy access to pension information at any time.

Tips for Maximizing Your Public Pension

Planning can help you get the most from your public pension. Simple actions today can increase your future retirement income and security.

- Keep Accurate Records: Maintain detailed records of all contributions and employment history to ensure accuracy and transparency.

- Review Annual Statements: Check for errors or missing donations on a regular basis.

- Understand Local Laws: Stay informed about changes in pension regulations and eligibility rules.

- Consider Voluntary Contributions: Make extra payments if your system allows to boost your future benefits.

- Plan Retirement Timing: Align your retirement age with benefit maximization rules.

- Coordinate International Contributions: If you work abroad, ensure contributions are combined or transferred correctly.

- Seek Professional Advice: Consult pension experts for strategies to optimize benefits.

To Sum Up

Understanding public pension contributions and claiming processes is essential for a secure retirement.

By staying informed and planning, you can maximize your benefits and avoid delays or errors.

Take action today by reviewing your contributions and preparing your claim to ensure a stable future.