Financing from Saison spans cards, personal loans, and home or remodeling programs across multiple markets.

This guide maps rates, limits, fees, eligibility, and application steps so you can compare options and plan disbursal timelines. Clear checklists and autopay setup protect pricing and keep repayments predictable.

Saison Global Scope and Availability

Saison operates across multiple countries through card-based cashing, unsecured installment loans, and home or remodeling finance delivered directly or via partners, and terms differ significantly by market, product tier, and applicant profile.

Saison Personal Loans

Fast access and predictable EMIs suit short-term needs when documentation is ready and income is stable.

Rates and Amounts

India-routed offers through Airtel Flexi Credit start around 12.99% p.a. for ₹25,000 to ₹6 lakh, often promising disbursal within 24 hours after final checks.

Privo-sourced flows typically cap near ₹2 lakh, carry tenures up to five years, and price between ~13.49% and 39.99% annually, depending on ticket size and risk.

Eligibility and Fees

Common screens include citizenship or eligible residency, age bands such as 21–59, and a stable monthly income of ₹25,000 in India. Processing generally runs up to 5%, while foreclosure policy varies by channel; several Privo pathways indicate no foreclosure fee, though sanction letters govern the final rule.

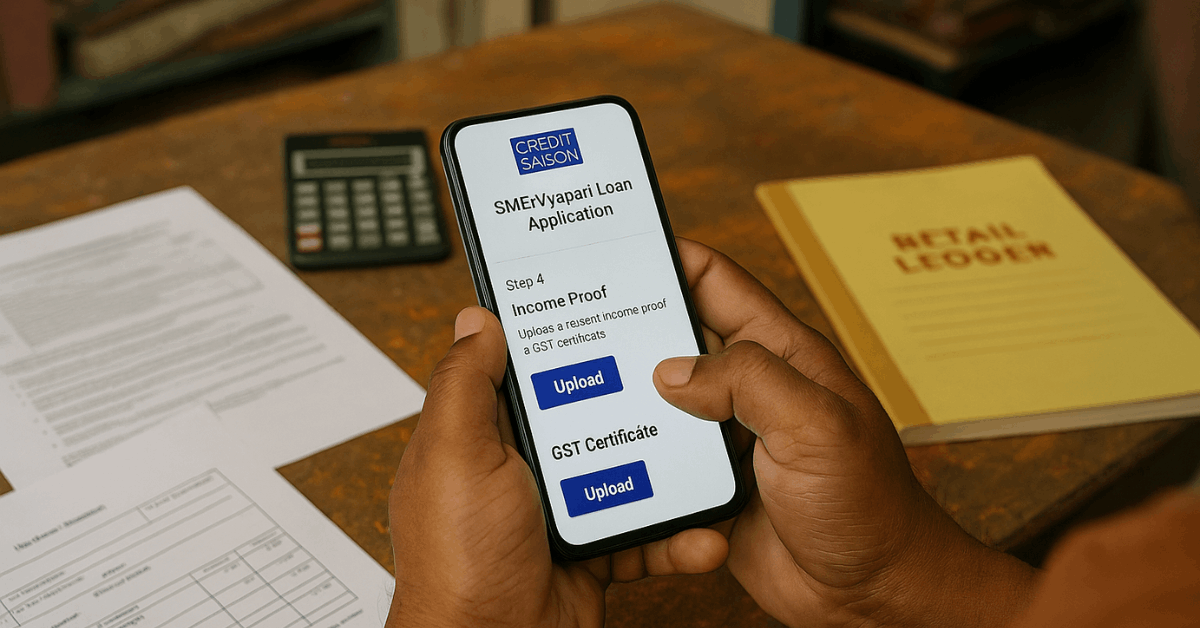

Saison Business, SME/Vyapari, and Doctor Loans

Growth capital without collateral trades higher APRs for speed, lighter paperwork, and working-capital flexibility.

Limits and Pricing

Business loans in India reach ₹10 lakh with rates starting near 22% p.a., and SME or Vyapari variants extend to ₹15 lakh with typical 12–36-month horizons for smaller merchant tickets.

Professional programs such as doctor loans commonly start around 13% p.a., reflecting stronger income visibility.

Fees and Exits

Representative processing fees fall around up to 4.72% for business lines and ~3% + GST for SME/Vyapari, late penalties often sit near ~3% per month + GST, and some products apply ~5% pre-closure on principal, which makes advance planning for early repayment essential.

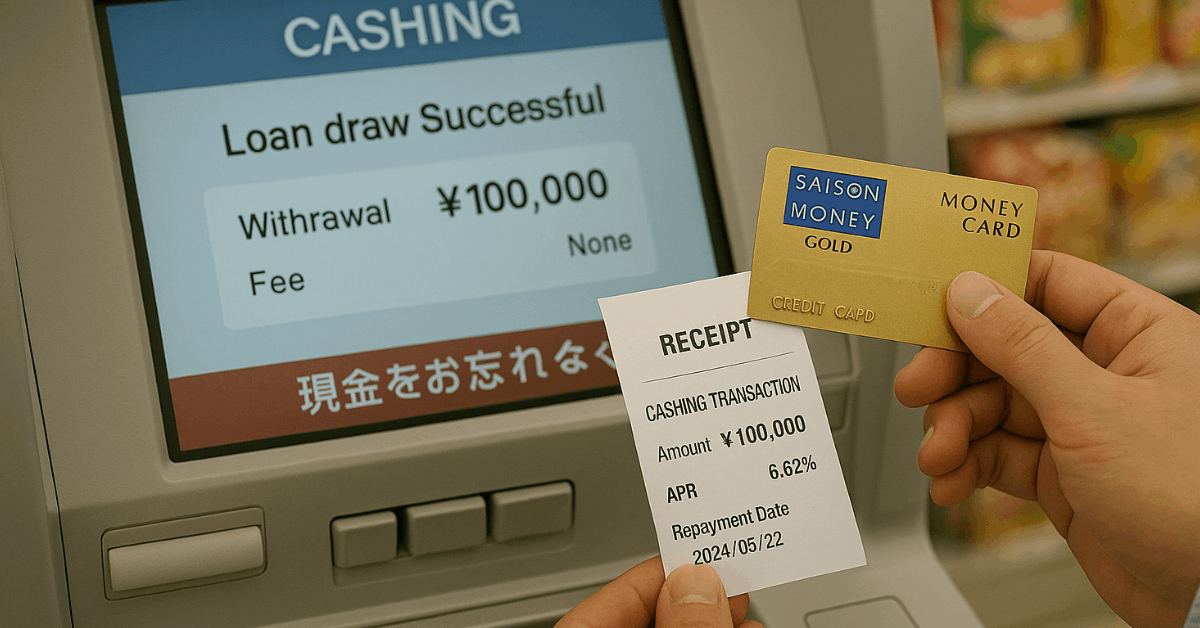

Card-Based Borrowing in Japan

Flexible draws against card credit lines support revolving or lump-sum repayment, long maximum terms, and campaign perks that reduce effective cost when used carefully.

A concise comparison helps you weigh lower-rate premium tiers against standard cashing lines.

Choosing Between Money Card Gold and Standard Cashing:

| Feature | Money Card Gold | General Saison Card (Cashing) |

|---|---|---|

| Interest Rate (APR) | 6.62%–8.62% | 2.8%–18.0% depending on limit and profile |

| Credit Limit | Up to ¥3,000,000 | Typically ¥1–¥1,000,000; higher on select cards up to ¥9,500,000 |

| Eligibility Basics | Age 20–75 and annual income ≥ ¥4,000,000; students, full-time homemakers, and pension-only applicants usually excluded | Broader screening tied to card program and verified income |

| Key Perks | No ATM or transfer fees, bank-transfer cashing, autodebit or ATM repayment, interest cashback up to two months for new borrowers | Standard card cashing functions and campaign-based perks |

| Repayment | Revolving or lump-sum per statement rules | Revolving or lump-sum per statement rules |

Additional Parameters

Product families list repayment periods from 1 to 110 months, and certain Money Card Gold or EX variants price on a prime-linked basis.

Late charges vary by product and typically fall between ~4.08% and 20.0% annually, which makes autopay an essential safeguard.

Home and Remodeling Finance

Property buyers and renovators tap long tenures and partner pricing when documentation meets program rules, and total cost hinges on fees as much as headline APR.

Japan Mortgage Channel (Flat 35)

Saison collaborates with the Japan Housing Finance Agency to route Flat 35 mortgages featuring industry-low fixed rates, preferred handling fees for eligible Saison or UC cardholders, and rate reductions up to −1.00% through discount points under defined conditions.

Japan Reform Loan

Fixed 4.700% nominal rate indexed to long-term prime +2.50%, effective APR ~4.745%–15.000%, ¥300,000–¥5,000,000 amounts, and 1–25 years tenure, extendable to up to 35 years for existing Saison mortgage users.

No guarantor or collateral is required, a ¥33,000 processing fee applies, and the entire application runs online without branch visits.

India Home Loans

Credit Saison India examples indicate limits up to ₹50 lakh and tenures up to 20 years, with final pricing set case-by-case.

Document sets typically include KYC, employment or business proof, salary slips or financials, and bank statements, and underwriting differs for salaried versus self-employed profiles.

Key Terms, Fees, and Repayment Methods

Cost control improves once repayment tools and ancillary charges are mapped against cash flow and pay cycles across regions.

What to Expect

Processing fees are commonly up to 5% on personal loans, ~3%–4.72% on business or SME lines, and flat handling or processing fees on secured or remodeling products.

Late penalties in India often quote ~3% per month + GST for commercial lines, while Japanese card loans reference annualized late ranges around 4.08%–20.0% by product.

Repayment methods include autodebit, ATM, bank transfer through Net Answer or the Saison Portal, and barcode payments at convenience stores where supported, and lump-sum repayment on revolving balances reduces interest when surplus cash arrives mid-cycle.

Application Requirements and Documents

Skipping a single item triggers avoidable delays, so preparing core proofs in advance protects timelines and offer terms.

- Identity and Residency: Valid government ID, eligible residency or citizenship, and accurate address records that match application data.

- Age and Income Bands: Personal programs frequently screen 21–59 in India and 20–75 for Money Card Gold in Japan, alongside defined income thresholds such as ₹25,000+ monthly or ¥4,000,000+ annual.

- Income Proof: Recent salary slips, bank statements, or audited financials for self-employed applicants, aligned to requested limits and tenure.

- Credit History: Clean delinquency record, stable utilization, and consistent EMI performance that supports requested pricing and limits.

- Business Vintage: Merchant or SME lines expect operating history, basic tax filings, and shop or GST documents consistent with turnover.

How to Apply and Get Disbursed

Channel choice, document readiness, and verification speed decide timelines more than any headline APR promise, so planning the route matters.

Digital Channels

India personal loans through partners such as Airtel Flexi Credit or Privo support end-to-end online journeys with common same-day or next-day disbursal after e-KYC, bureau checks, and bank verification.

Japanese cashing lines initiate in card portals or apps, while online repayment setup through Net Answer streamlines post-approval management.

Branch-Guided Flows

Mortgage or remodeling applications in Japan follow partner workflows that capture property or project documents, and India home loans rely on standard property and income diligence before final sanction, which makes early checklist assembly the fastest path to issuance.

Practical Approval Tips

Minor preparation steps often translate into lower rates, smoother underwriting, and fewer post-disbursal surprises.

- Right-Size the Request: Calibrate limit and tenure to cash-flow needs, improving approval odds and reducing total interest paid across the term.

- Stabilize Bank Hygiene: Maintain predictable salary credits and EMI hits, which strengthens automated risk checks and keeps pricing bands favorable.

- Package Documents Once: Create clean PDF sets for KYC, income proofs, and address documents, and reuse them across channels to prevent resubmissions.

- Audit Fees and Exits: Compare processing, late, and pre-closure rules across products to avoid punitive charges when plans change unexpectedly.

- Automate Repayments Early: Enable autopay on day one and set calendar reminders that protect credit scores and eliminate late-fee leakage.

Conclusion

Choose the product that fits cash flow, documentation readiness, and repayment discipline. Align limit, tenure, and fees to realistic income and set autopay before the first due date.

If terms differ across channels, prioritise programs that lower total cost and provide faster service so your approval, disbursal, and repayment remain predictable.