Getting a Seven Bank loan stays straightforward once eligibility and documents align.

Apply fully online, use the existing cash card to draw funds at Seven Bank ATMs or through Direct Banking, and follow a fixed monthly schedule for predictable budgeting.

Eligibility depends on age, account status, residency, and joint screening by Seven Bank and Acom, so submit clear identification images and accurate details to avoid rework and delays.

Seven Bank Loan Application Methods And Timeline

Starting correctly reduces rework, especially around identity images and account setup. Plan for card delivery time if opening a new account alongside the loan.

Step 1: Prepare Documents

Gather official identification and ensure images are complete and legible. If using a health insurance card that shows the address on a different side or page, capture and upload that side as well, or the identity check may fail.

Step 2: Submit The Application

Access the Direct Banking Service if already a Seven Bank account holder, then apply for a new limit or a limit increase.

If not yet an account holder, submit an account opening application and the loan application together; account issuance and cash card delivery typically require one to two weeks before service use.

Step 3: Screening Result

Expect an email notification to the registered address, often within a few business days at the earliest. Responses vary by individual review, and additional confirmation may be requested.

Step 4: Agreement And First Use

After receiving the agreement-completion notice by email, start borrowing via Seven Bank ATMs or the Direct Banking Service.

Funds drawn through Direct Banking post to the ordinary deposit account; cash withdrawals from that account at ATMs may incur standard ATM usage fees.

Eligibility And Screening

Confirming eligibility early prevents avoidable rejections and delays. The loan is guaranteed by Acom Co., Ltd., and applications are jointly screened.

Who Can Apply

Applicants must hold a Seven Bank account as individuals, be at least 20 years old and under 70 at agreement, and satisfy internal screening standards set by the bank and the guarantor.

Foreign nationals must hold permanent resident status in Japan to qualify for the agreement.

Screening And Guarantor

Loan screening is performed by Seven Bank and Acom Co., Ltd., and applications may be declined based on results.

If repayment remains past due and the guarantor repays Seven Bank on a borrower’s behalf, subsequent transaction handling transfers to Acom as the service counter.

Borrowing And Access To Funds

Knowing where and how funds arrive helps you pick the fastest path and minimize fees.

Where And When Borrowing Is Available

Loan borrowing is available in principle 24 hours a day, 365 days a year via Seven Bank ATMs and the Direct Banking Service.

Borrowing at ATMs uses the existing cash card and the same PIN as deposits; borrowing via Direct Banking transfers funds to the linked ordinary deposit account.

Amount Units And Channels

ATM borrowing uses units of 1,000 yen per transaction, while Direct Banking allows transfers from 1 yen. Borrowing on other banks’ ATMs is not supported, and the borrowed amount counts toward the daily ATM withdrawal limit.

Repayment Options And Schedule

Predictable minimums support planning, while optional repayments help shorten interest costs and clear balances sooner.

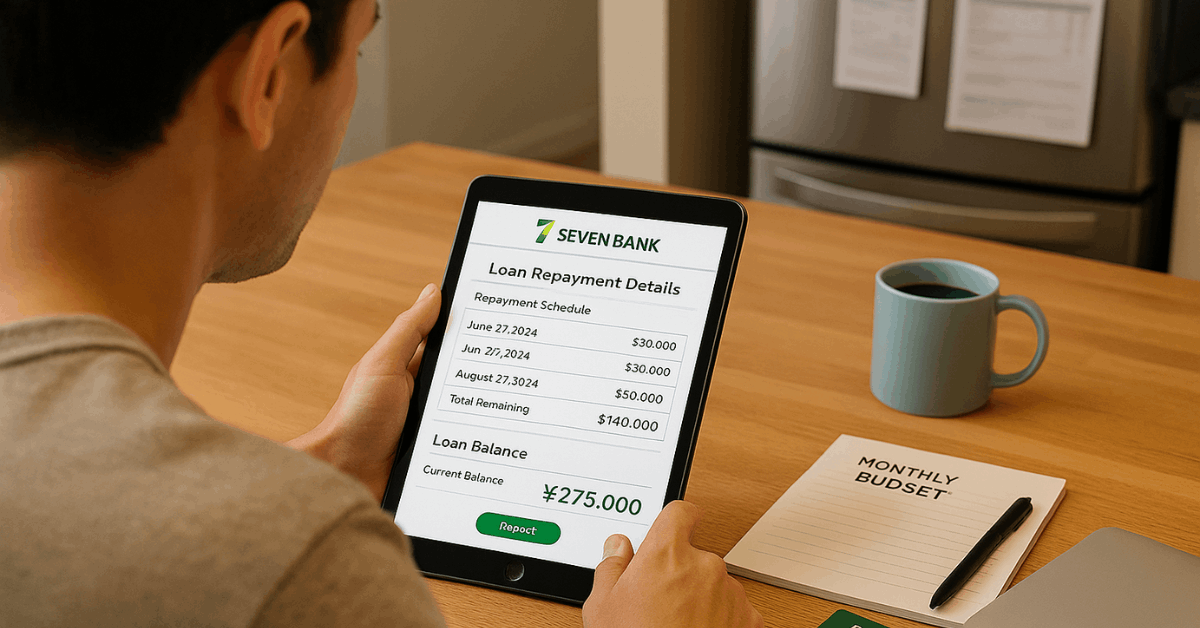

Scheduled Monthly Repayment

On the 27th of each month (next business day if it falls on a weekend or holiday), a fixed amount is withdrawn from the ordinary deposit account based on the prior month’s loan balance.

The first repayment occurs on the second monthly repayment date after a new borrowing, unless the borrowing occurs on a repayment date, in which case the first repayment is the next date.

| Loan balance as of prior scheduled date | Monthly repayment amount |

| Not more than 100,000 yen | 2,000 yen |

| More than 100,000 yen to 200,000 yen | 4,000 yen |

| More than 200,000 yen to 400,000 yen | 6,000 yen |

| More than 400,000 yen to 600,000 yen | 8,000 yen |

| More than 600,000 yen to 800,000 yen | 10,000 yen |

| More than 800,000 yen to 1,000,000 yen | 15,000 yen |

| More than 1,000,000 yen to 1,500,000 yen | 20,000 yen |

| More than 1,500,000 yen to 2,000,000 yen | 25,000 yen |

| More than 2,000,000 yen | 35,000 yen |

Optional Repayment

In addition to scheduled debits, optional repayments can be made at any time by depositing an extra amount, which reduces principal sooner and may lower total interest.

Interest Rates And Borrowing Limits

Rates vary by approved limit and screening outcomes, and limits can grow after on-time usage history.

Interest Rate Tiers

Illustrative tiers provided in public materials show 15% per annum for 100,000 to 500,000 yen, 14% per annum for 700,000 to 1,000,000 yen, 13% per annum for 1.5 to 2.0 million yen, and 12% per annum for 2.5 to 3.0 million yen.

Actual rates depend on screening and may differ across intermediate bands.

Borrowing Limit And Increases

The maximum limit at first approval for new applications is up to 500,000 yen.

After at least six months of transactions and satisfactory review, a limit increase application may be considered, with possible ceilings at 500,000 yen or up to 3,000,000 yen depending on screening results.

Fees And How To Minimize Charges

Small transaction choices can trim costs without changing repayment behavior. Use these tactics to avoid leakage.

Rely on free ATM deposits and balance inquiries whenever possible to monitor repayment status without added cost.

Consolidate transfers when practical, since transfers to Seven Bank accounts cost 55 yen and to other banks cost 165 yen per transaction.

Prefer Direct Banking for borrowing and repayments to avoid per-transaction borrowing or repayment fees, then plan ATM cash withdrawals to minimize any standard ATM usage fees.

Security And Customer Support

Protecting credentials and documents keeps the account safe while speeding up screening and future limit reviews.

Seven Bank employs encryption for online sessions, enforces secure authentication, and monitors for suspicious activity, while customers should update passwords regularly and avoid public Wi-Fi for banking actions. The same PIN controls both deposit and loan transactions on the cash card, so stronger device security and careful PIN handling remain essential.

For assistance in Japanese, contact 0088-21-1189; for English support, contact 0120-937-711, Monday through Saturday, 9:00–18:00. The head office address is 1-6-1 Marunouchi, Chiyoda-ku, Tokyo 100-0005, Japan.

Important Notes And Agreement Terms

The agreement term runs for one year and auto-renews under the Loan Service Terms and Conditions; new borrowing is not available from the first day of the month after a borrower turns 71.

Applications are only accepted for Seven Bank account holders, and customers without an account must open one and receive the cash card before using the service. Borrowing at non-Seven Bank ATMs is not available.

If repayment becomes continuously past due and the guarantor settles the debt to Seven Bank, Acom Co., Ltd. becomes the point of contact for future handling.

Fees Recap And Statement Access

Borrowing and repayment via the loan service do not incur service fees, while ATM cash withdrawals from the ordinary deposit account may incur standard ATM usage fees.

Online statements provide transaction history, available limits, and repayment records at a glance.

Disclaimer

Information provided here is general and does not constitute financial advice. For personalized guidance, consult a qualified advisor or contact Seven Bank directly for current terms, rates, and requirements.

Conclusion

Solid preparation speeds approval and keeps costs down throughout the agreement. Monitor balances and statements online, allow the scheduled debit from the ordinary deposit account, and add optional repayments to reduce interest.

Prefer Direct Banking for borrowing and repayments, then plan ATM cash withdrawals to limit standard usage fees. Review renewal and age limits in the terms, and confirm current rates and requirements directly with Seven Bank if anything changes.