Fast access and bank-grade oversight define Shinsei Bank Card Loan, launched on October 1, 2011 as an unsecured personal loan designed for rapid, responsible borrowing.

Applications, screening, and disbursement run through Lake unmanned branches, ATMs, call centers, and the official website for same-day availability.

Clear eligibility, a valid Shinsei Bank account, and precise, matching identification keep your process simple while broad channel coverage shortens the path from submission to first drawdown.

Shinsei Bank Card Loan: Lake

Fast access paired with bank-grade controls defines Shinsei Bank’s unsecured personal loan under the “Lake” brand.

Launch And Positioning

Shinsei Bank launched the Shinsei Bank Card Loan: Lake on October 1, 2011 as an unsecured personal loan positioned for speed, accessibility, and responsible bank operation.

The product blends consumer-finance convenience with the safety and oversight that borrowers expect from a regulated bank program.

Application And Disbursement Channels

Applications, screening, and disbursement run through Lake unmanned branches, ATMs, call centers, and the official website, giving applicants multiple same-day options.

A nationwide unmanned network of roughly 800 locations expands reach for customers who prefer in-person self-service without branch queues.

Brand And Network Strength

The Lake brand maintains high share in new applications due to sustained marketing and wide channel coverage. Strong brand recall and easy access points shorten the path between inquiry, screening, and first drawdown.

Integration Notes

Existing borrowers of Shinsei Financial continue under their current terms, while new applicants are routed to the unified Shinsei Bank Card Loan, Lake platform.

Consolidation under one platform simplifies servicing and creates consistent repayment arrangements.

Eligibility to open a Shinsei Bank account

Missing basic prerequisites forces re-submissions and slows loan timelines, so confirm these points before applying.

- Core eligibility: Residency in Japan is required, together with at least six months of residence or employment at a company with a Japan office; part-time roles do not satisfy employment criteria.

- Local contactability: A personal Japanese telephone number is mandatory; workplace numbers or numbers belonging to others are not accepted.

- Application type: Corporate applications, joint accounts, and post office box addresses are not accepted for retail account opening.

- PEPs procedure: Foreign Politically Exposed Persons must visit a branch and complete in-person onboarding.

- Visa status exclusions: Short-term, diplomatic, or official visa holders, and individuals in Japan under six months without qualifying employment, are ineligible.

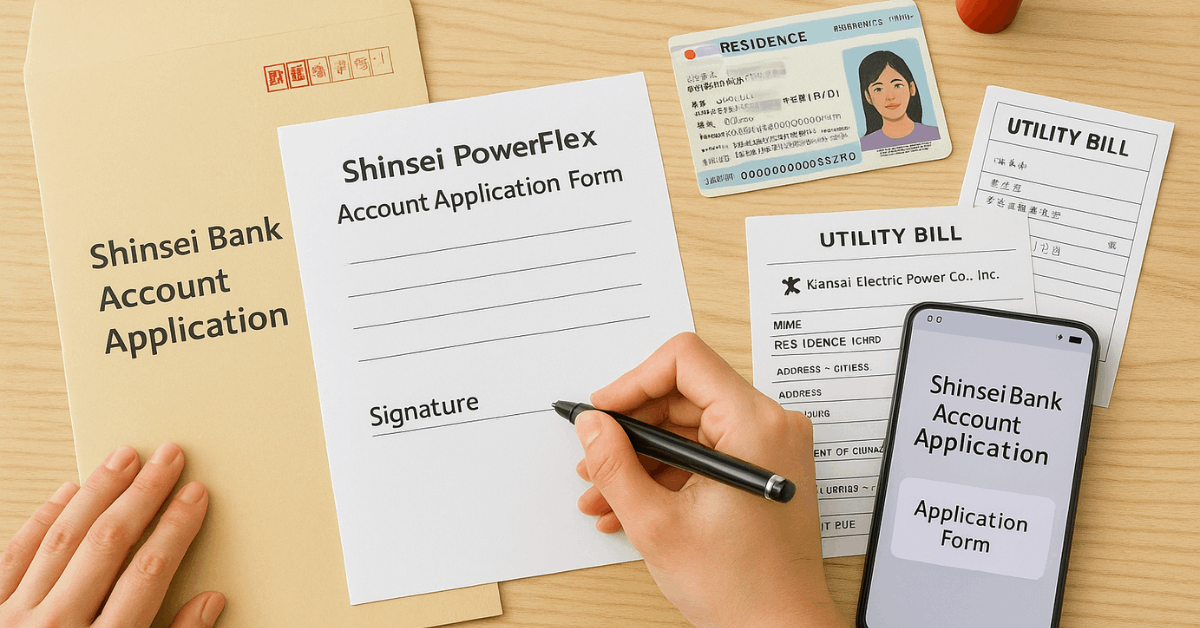

Required identification documents for a PowerFlex account

Clean, matching identification prevents rework; ensure names and addresses on IDs match the application exactly, including spelling and order.

Primary Residency Document

Provide a photocopy of a Residence Card or Special Permanent Resident Certificate.

Photocopy both sides, verify the current address is shown, and confirm that name, address, date of birth, and the upper-right card number are clearly legible. Nicknames are not accepted, and unclear images trigger document resubmission.

Secondary Identity Or Address Document

Submit one of the following: Japanese driver’s license (photocopy), My Number Card (front only, photocopy), original Residence Certificate (Juminhyo, issued within six months), or original utility bill receipt for landline, electricity, water, gas, or NHK issued within six months.

Driver’s licenses must show clear seals and any reverse-side updates; My Number back sides are not required and personal organ donation areas should be blacked out.

Residence Certificates should exclude Individual Number and Honseki-chi or have those fields redacted; utility receipts must show matching name and address and cannot be reminders or nonpayment letters.

U.S. Tax Status Note

Applicants who are U.S. persons under U.S. tax law must provide additional documentation as requested for FATCA compliance. Prompt responses to these requests reduce review time and prevent account opening holds.

Account Opening: Step-By-Step (Post Method)

Delays usually occur when addresses are inaccurate or originals are missing, so prepare for these three steps in order.

Apply Online

Complete the online form; a printed application arrives at the registered address in about one week. Returned mail marked “address unknown” halts processing, so ensure exact name and address entry matching your IDs.

Mail Back The Signed Form And IDs

Enclose the signed application and required identification in one envelope and post to the bank. Processing typically takes seven to ten business days, and submitted forms or identification are not returned.

Receive Cash Card And PIN

The cash card arrives via simple registered mail (Kani kakitome) and the PIN via acceptance-recorded mail (Tokutei kiroku yubin) on separate days.

Missed deliveries generate a post notice; arrange redelivery with Japan Post. Card embossing may truncate long names due to character limits.

Shinsei Bank Loan Application: Process

Small preparation gaps extend screening, so align product fit, documents, and account readiness before submitting a loan request.

Confirm Eligibility And Product Fit

Check income stability, residency status, and any product-specific criteria set by Shinsei Bank for the chosen loan.

Foreign nationals should ensure a valid status of residence and sufficient length of stay or qualifying employment to satisfy underwriting.

Prepare Documents

Gather your Residence Card or Special Permanent Resident Certificate, income proofs such as recent payslips or tax statements, and any additional bank-requested forms tied to your profile.

Clean scans and consistent name and address details reduce follow-ups during screening.

Start And Submit The Application

Initiate the application through the Lake website, an unmanned branch terminal, an ATM entry point, or the call center as available for the product.

Complete all fields carefully, review repayment account details, and submit once the information is consistent with your identification and bank records.

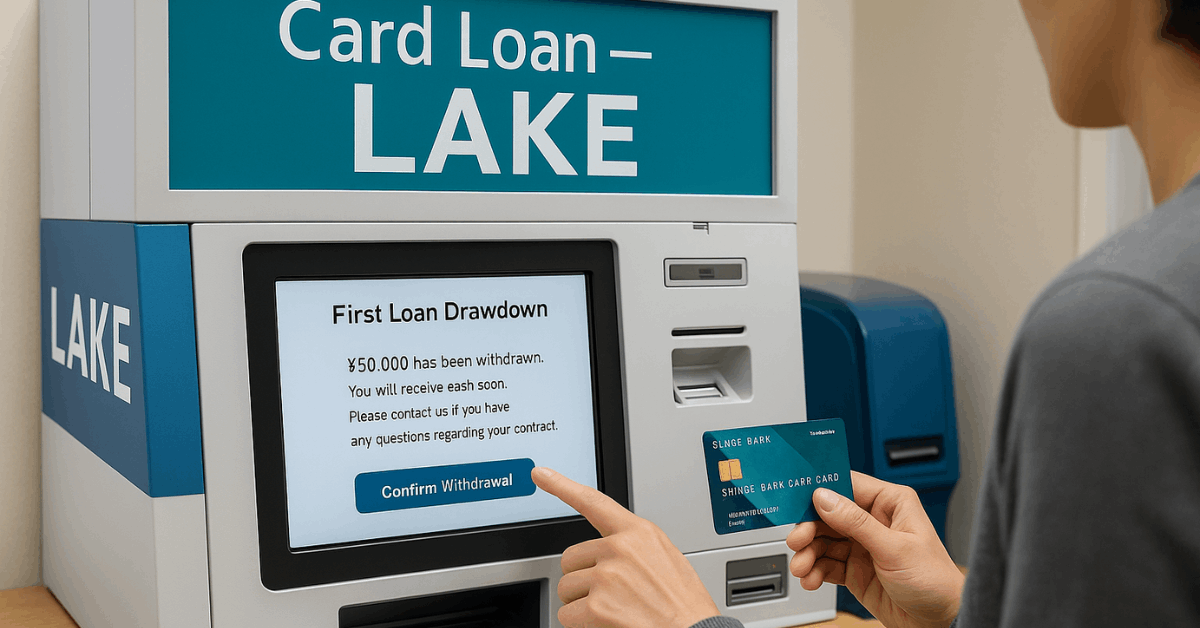

Review, Decision, And First Drawdown

Credit assessment runs after submission, and outcomes are communicated through the selected channel.

Upon approval, follow instructions to finalize the agreement and confirm repayment account linkage, then proceed to first drawdown using designated channels.

Account Integration And Repayment Requirements

Repayment automation depends on a valid Shinsei Bank account in good standing; align account data before loan finalization.

Linked Repayment Account

An active Shinsei Bank account must be designated for direct debits on scheduled dates. Maintaining sufficient balances on debit dates protects credit standing and prevents late-payment fees or automated retries.

Financial Verification

Recent bank statements or income proofs may be required to confirm repayment capacity, particularly for higher limits. Consistent deposits and stable employment histories typically strengthen screening outcomes.

Contact And Identity Consistency

Ensure address, phone number, and email in bank records match those shown on identification and the application. Additional identity verification may be requested to complete account-loan linkage or to satisfy compliance checks.

Practical compliance with address matching, residency documentation, and repayment account setup keeps applications moving without interruption. Solid preparation across these checkpoints positions applicants for faster screening and predictable disbursement.

Conclusion

Firm preparation delivers a smoother outcome and predictable funding. Confirm eligibility, organize required IDs, align a Shinsei Bank repayment account, and keep contact details consistent across records to avoid resubmissions and holds.

Maintaining sufficient balances on debit dates and responding promptly to any verification requests keeps your account in good standing and your future drawdowns available without delays.