Clear rules govern approval for SMBC loans in Japan, and aligning your profile early helps avoid delays and surprise costs.

Rate mechanics, including base rate reviews, floating and fixed options, and first change dates tied to disbursement and bonus months, are explained in plain terms for practical budgeting.

Step-by-step application guidance, required documents, repayment patterns, fees, and contact routes round out the essentials so you can compare products and prepare a clean file.

What Will You Need to Be Eligible

Strong applications meet age, residency, income, and credit conditions that signal capacity to repay.

Age And Residency

Applicants must be at least 20 at application and no older than 80 at final repayment.

Japanese citizens and foreign nationals residing in Japan with a valid visa qualify, provided a stable income and a registered address are documented with identity and residency proofs.

Employment And Income

Stable earnings carry meaningful weight at approval. Full-time employees should show at least one year in the role, while self-employed and contract workers generally target two or more years of history.

Annual income commonly starts around ¥5,000,000 for larger housing amounts, subject to product, requested limit, and risk review, supported by payslips or tax returns.

Credit History And Loan Purpose

Clean, on-time repayment behavior improves approval odds and rate offers.

Housing funds must support purchase, construction, renovation, or refinancing, and the collateral property must meet bank standards; approved amounts cannot exceed appraised value.

Interest Rates And How Reviews Work

Loan pricing references a “base interest rate,” which reflects the bank’s secured-loan standard for individuals.

That benchmark incorporates funding costs, operating costs, and target revenues, with funding costs reacting to long-term interbank rates and government bond yields observed before the change date.

New rates after a review track the base rate from the month prior to the change date and take effect the day after that date; debits at the revised rate begin the following month.

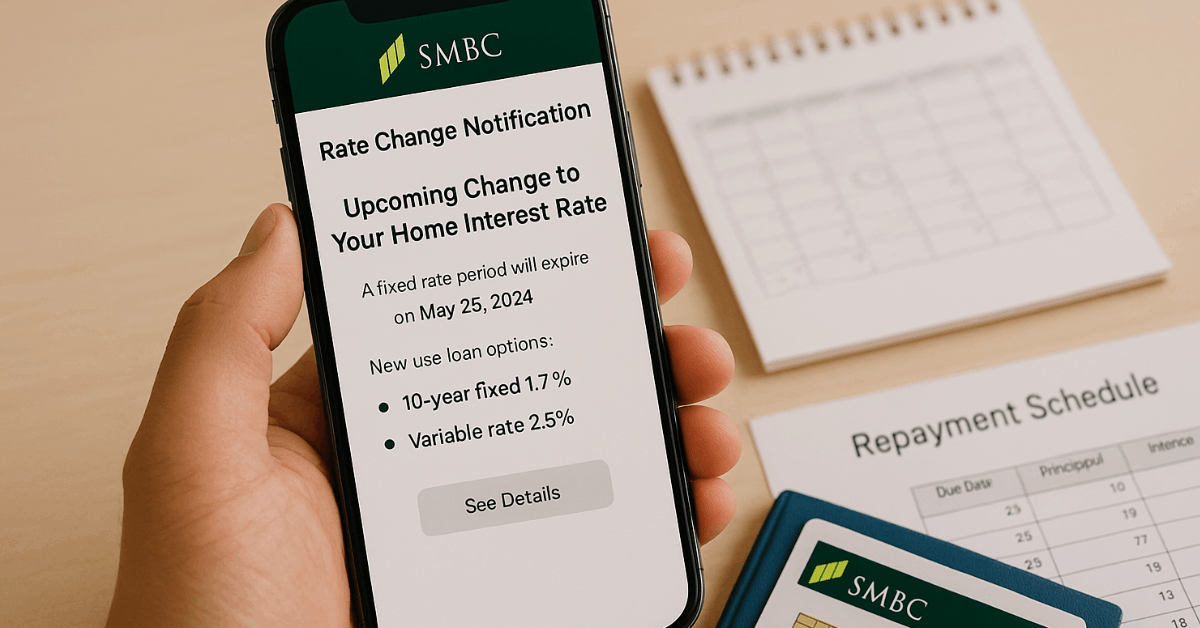

New Fixed Terms

Fixed-rate periods run for a chosen term, then, unless a new fixed term is requested through prescribed procedures, switch to a one-year renewal structure.

Customers on fixed plans receive a notice about two months before the fixed period ends, which is the practical window to reselect terms if desired.

Interest-Rate Change Dates — Floating Plan (1-Year Renewal)

Uncertainty around the first change date often causes budgeting errors; use the matrix below to align your disbursement month and bonus months.

| Repayment pattern | Disbursed Jan 1–Aug 31 | Disbursed Sep 1–Dec 31 |

| Monthly only or bonus Dec/Jun | Dec 26 of the current year | Dec 26 of the next year |

| Bonus Jan/Jul | Jan 26 of the next year | Jan 26 of the year after next |

| Bonus Feb/Aug | Feb 26 of the next year | Feb 26 of the year after next |

For example, a loan disbursed on August 1, 2024, with a monthly only or Dec/Jun bonus will change on December 26, 2024, whereas a September 1, 2024, disbursement pushes that initial change to December 26, 2025.

Interest-Rate Change Dates — Fixed Plans (3/5/7/10 Years)

Picking a fixed-term lock pricing for a period, after which the initial change date depends on disbursement timing and any bonus months.

| Fixed term | Monthly only or bonus Dec/Jun | Bonus Jan/Jul | Bonus Feb/Aug |

| 3 years | Dec 26 in 2 years (Jan–Aug) / in 3 years (Sep–Dec) | Jan 26 in 3 / in 4 years | Feb 26 in 3 / in 4 years |

| 5 years | Dec 26 in 4 / in 5 years | Jan 26 in 5 / in 6 years | Feb 26 in 5 / in 6 years |

| 7 years | Dec 26 in 6 / in 7 years | Jan 26 in 7 / in 8 years | Feb 26 in 7 / in 8 years |

| 10 years | Dec 26 in 9 / in 10 years | Jan 26 in 10 / in 11 years | Feb 26 in 10 / in 11 years |

As an illustration, a 10-year fixed loan disbursed on August 1, 2024, with monthly only or Dec/Jun bonus changes on December 26, 2033, while a September 1, 2024, disbursement changes on December 26, 2034.

Loan Terms, Repayment Method, And Prepayment

Housing maturities typically span one to thirty-five years, while personal and other products align terms to purpose and risk. Floating rates undergo annual reviews, and fixed rates hold for three, five, seven, or ten years per selection.

Monthly repayments debit automatically from a designated account on a scheduled day, and many borrowers pair standard debits with semiannual “bonus” increases to shrink principal faster.

Early or lump-sum repayments reduce interest over the life of the loan; confirm any conditions on partial or full prepayment, and check how interest is recalculated when principal changes mid-cycle.

Fees and Charges

Hidden costs derail budgets, so confirm fees alongside the nominal rate. Origination fees vary by plan; “A Plan” commonly runs at 2.2% of the loan amount, while “B Plan” uses a fixed fee stated in the contract.

Administrative charges may apply when switching between floating and fixed, or when resetting a fixed term at expiry. Partial or full early repayments can trigger handling fees depending on product and channel.

Late payments typically incur a higher annualized charge on overdue balances; avoid calendar drift around change dates and bonus months.

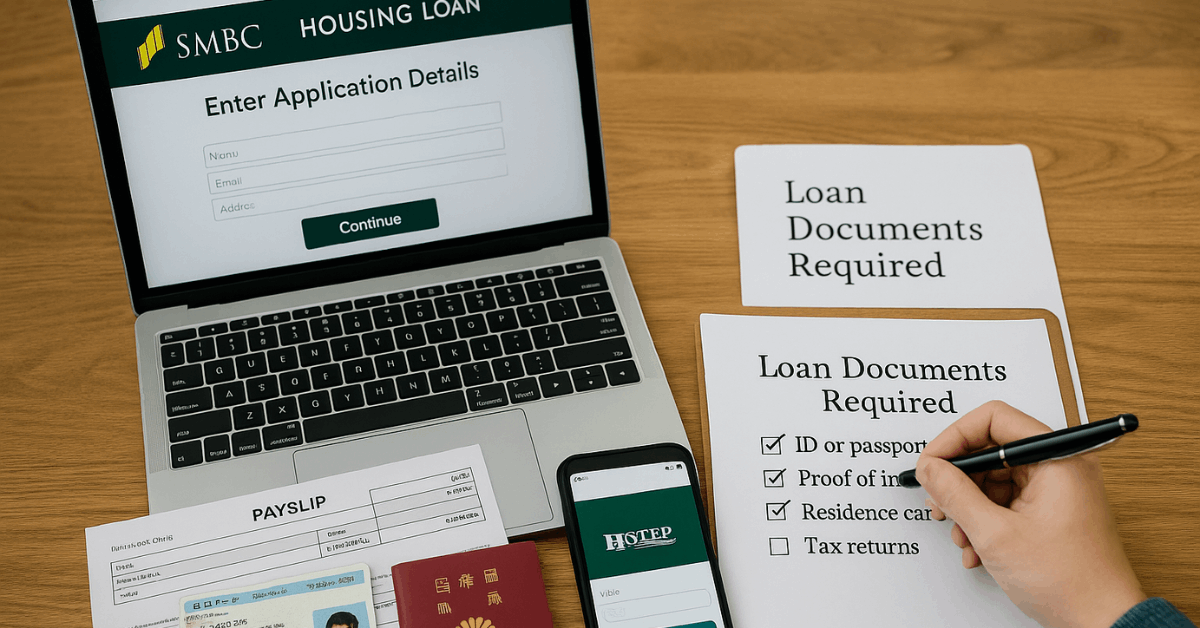

How to Apply: Online or In-Branch

Streamlined applications move faster when documents are ready and inputs are consistent across forms.

- Start an inquiry online or at a branch, select a loan type, and provide personal, employment, and amount details aligned to stated purposes.

- Upload or submit documents for identity, residency, income, and—when relevant—property and contractor information.

- Complete underwriting steps, including any interview to confirm terms and repayment options, then review the approval.

- Sign the agreement and satisfy any remaining conditions; housing disbursements usually flow directly to the seller or contractor, after which a repayment schedule arrives for your records.

Required Documentation

Clean scans and consistent identifiers prevent avoidable back-and-forth. Identity and residency usually require a passport or residence card plus a certificate of registered address.

Income and employment typically involve recent payslips, tax returns, and employment verification.

Foreign nationals should prepare visa or residence status documents; co-borrower or guarantor information may be requested for housing solutions or larger exposures.

Snapshot Of SMBC Loan Types In Japan

Product availability and pricing vary by applicant profile and collateral; use these ranges as directional anchors when comparing.

Personal Loan

General-purpose borrowing covers tuition, travel, medical costs, and emergencies without collateral.

Typical bands run from roughly ¥100,000 to ¥5,000,000, with representative rates often cited between about 3.0% and 14.5% annually, sized to credit strength and requested amount.

Business Loan

Working capital, payroll, and expansion finance rely on company financials and purpose notes. Custom quotes reflect business health, tenure, and security, and seasoned clients may see faster cycles for prequalified limits.

Housing Loan

Home purchase, construction, renovation, or refinancing options combine longer terms and collateral appraisal.

Floating samples sometimes begin near 2.63%, while fixed ten-year illustrations can sit as low as 0.86% for strong profiles, subject to eligibility, insurance, and contract conditions.

Education Loan

Tuition, books, and housing costs for domestic or international study are supported with proof of enrollment and student ID.

Rate examples often start around 2.975%, with grace features that defer repayment until graduation to protect early-career cash flow.

Auto Loan

New or used vehicles can be financed over one to seven years, backed by income verification and purchase documents.

Typical ranges cluster near 1.5% to 4.5% annually, with proceeds frequently remitted directly to the dealership and insurance requirements set out in the contract.

Customer support and contact

Clear channels help at every stage, whether you are confirming eligibility or rescheduling a debit.

Phone and Digital

Customer service commonly answers weekdays from 9:00–17:00 at 0120-004-847, while online inquiries route through the official loan portal; many borrowers also use chat during business hours for quick questions.

Branch and Address

In-person support is available by appointment at selected branches, and secure correspondence routes to 1-1-2 Marunouchi, Chiyoda-ku, Tokyo 100-0005, Japan.

Maps and appointment options appear on the website so you can coordinate documents and signatures efficiently.

Important: Credit always carries risk. Review the latest SMBC or SMBC Trust Bank terms, confirm all fees, and verify how rate reviews, bonus months, and change dates affect your monthly debit and total interest over time.

Conclusion

Strong preparation makes the financing process predictable. Align your profile to eligibility rules, validate the loan purpose and collateral standards, and select a rate structure that fits your cash flow and risk tolerance.

Track first change dates tied to disbursement and bonus months, set reminders for fixed period notices, and budget for origination, switching, and early repayment fees.

Keep documents clean and consistent to shorten underwriting, and monitor the base rate review cycle so revised debits match expectations. For any edge case, contact SMBC through the published phone line, online portal, or a booked branch visit before signing.